Featured

- Get link

- X

- Other Apps

Should You Retire During a Recession? Consider These 3 Crucial Factors First.

The term "recession" often leaves a bitter aftertaste for most individuals. To the overwhelming majority, this word doesn’t bring about anything positive—it conjures up images of financial instability, employment cuts, falling stock prices, shrinking pension funds, and increased anxiety.

A recession It can affect almost everybody’s financial situation, yet it poses an even larger impact on retirees or those nearing retirement since they lack sufficient time to recuperate from its effects.

Where should you put your $1,000 investment at this moment? Our analysis group has recently disclosed their insights into what they consider to be the top choices. 10 best stocks to buy right now. Learn More »

It's virtually impossible to predict with complete confidence whether a recession is coming Some believe the warning signs are present, whereas others feel the concern is exaggerated. Regardless, it’s wiser to come prepared rather than being caught off guard.

When contemplating retirement and questioning whether it’s the right move, keep these three factors in mind.

1. Does your investment portfolio have what it takes to handle stock market downturns?

Reducing exposure to volatile stocks is a sure way to recession-proof your portfolio . Additionally, as you approach retirement, you can shield your nest egg by diversifying beyond stocks.

Significantly, if the stock market declines substantially as you approach or enter retirement, this could rapidly deplete your savings due to negative returns, possibly leaving insufficient funds to meet living costs. This scenario is referred to as "sequence of return risk" and has the potential to reduce the longevity of your retirement nest egg—particularly if it happens at the beginning stages of retirement.

Transitioning your portfolio to include more bonds and cash while approaching retirement is a solid strategy to reduce risk and provide some stability.

Bonds typically don't have the upside of stocks, but they also far less riskier than stocks, assuming you're buying high-quality bonds . You generally don't have to worry about losing money during recessions.

Maintaining at least two years’ worth of bonds and cash reserves might assist you in avoiding the necessity to liquidate stocks during significant market downturns.

2. When do you plan to claim Social Security?

Social Security serves as a crucial financial resource for numerous retirees. Fortunately, Social Security The benefits are unaffected by changes in the stock market. Should your monthly Social Security benefit be $2,000, it will stay at that amount regardless of conditions in the stock market or overall economy.

If you can manage with just your Social Security income (which many retirees cannot do), then retiring during an economic downturn might not have such a direct impact since you wouldn’t need to draw funds from other accounts like your savings or investments. brokerage account .

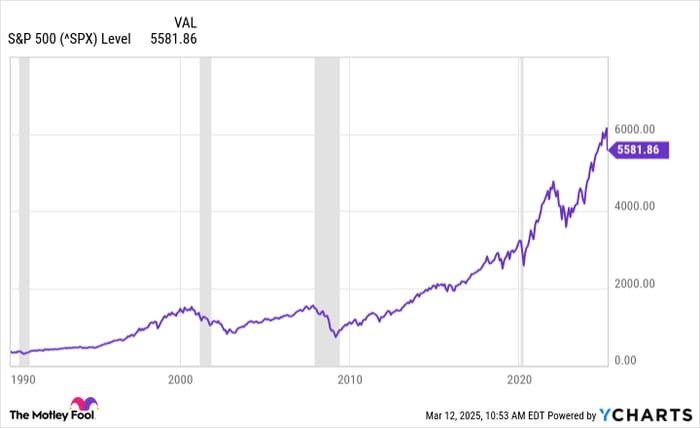

This might provide you with additional time to potentially recover if stock values plunge during an economic downturn. Over the last four recessions, share prices declined considerably; however, they ultimately rebounded every single time.

^SPX data by YCharts The gray vertical sections indicate periods of recession.

Previous events do not ensure future outcomes, and you should not presume you will have time for your investment portfolio to recover if it takes a steep drop. Nevertheless, patience comes more easily when your stock portfolio does not directly impact your daily life.

3. Would you be comfortable with implementing a flexible withdrawal plan?

Being open to change is more important than the initial withdrawal strategy you use when you go into retirement.

Take the " 4% Rule ," for example, which says retirees can withdraw 4% of their retirement savings in the first year of retirement and then adjust the withdrawal amount according to inflation every year after without worrying about outliving their savings.

This strategy has worked for many retirees, but it's not as effective during recessions or down periods in the market because it can accelerate how fast you go through your savings.

The 4% Rule is just one example, but it highlights how a dynamic withdrawal approach -- one that you're willing to adapt at short notice -- is needed to ensure you're not put in a position where you could possibly outlive your savings.

Retiring during a recession isn't the best idea and can come with added stress. However, it's not an impossible task, and many have navigated it successfully. The best thing you can do is diversify your portfolio beforehand and be open to adjusting your withdrawal strategy along the way.

The $ 22,924 Social Security bonus most retirees completely overlook

If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $ 22,924 more... each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we're all after. Just click here to find out how you can gain deeper insights into these tactics.

Check out the "Social Security Secrets" »

The Motley Fool possesses a disclosure policy .

- Get link

- X

- Other Apps

Popular Posts

ABC Apologizes After Claudia Long Fabricates False Claims About Two High-Profile Politicians

- Get link

- X

- Other Apps

Oyetola Names Adeniran Aderogba New President/CEO of RMDB – Exclusive International Update

- Get link

- X

- Other Apps

Comments

Post a Comment